For investors with Concentrated Stock Positions, learn whether Exchange Funds are right for you

For many investors, especially wealthy investors, securing the best tax advantages is crucial to maximizing your returns.

One way to avoid a hefty tax bill on capital tax gains is to use specific tax techniques with exchange funds. These days, significant gains in the stock market have posed something of a dilemma for investors whose priority is to secure a low tax bill.

Consider a situation in which a tech employee receives a substantial amount of stock from their employer. Then over the years, thanks to the success of the company and strong economic conditions, the shares rise in value to $7 million and eventually dominate the portfolio. Now, the employee wants to diversify.

On the one hand, those soaring stock prices are something to celebrate. On the other hand, they can present major challenges when it comes to rebalancing. In this scenario, the employee has three main choices:

- Keep a concentrated position and assume the associated risks.

- Sell a portion of the position and pay a capital gains tax. (In California, that can be as high as 37.1%, and would climb to 56.7% under proposed federal legislation.)

- Use exchange funds to diversify without paying capital gains tax.

Often financial advisors do not recommend the first option of putting all your eggs in one basket. Instead, they recommend prioritizing diversity, so your portfolio isn’t vulnerable to the losses of just one stock. Afterall, the median stock in the Russell 3000 had a 31% chance of losing more than 30% of its value in one year. (About 22% of the Russell 3000 stocks lost more than a fifth of their value in the average calendar year.) Compare that to a 5% chance for similar losses for the overall Russell 3000 index—essentially a much lower chance of losses with more diversity.

The challenge for investors who don’t want to assume the risks of a concentrated position is that rebalancing in the traditional way of selling off shares can bring a large tax bill. That’s why many wealthy investors are turning to the third option—exchange funds. Compared to the sale of a stock, exchange funds may provide a substantial return advantage over investing after-tax proceeds from the sale.

Let’s review what exchange funds are, how they carry tax benefits, and how you can get the most out of exchange funds.

Benefits of Exchange Funds

Exchange Funds are similar to mutual funds in that the hold a basket of stocks that is benchmarked to a particular index like the S&P 500 (SPX) or the Russell 1000 (RUI).

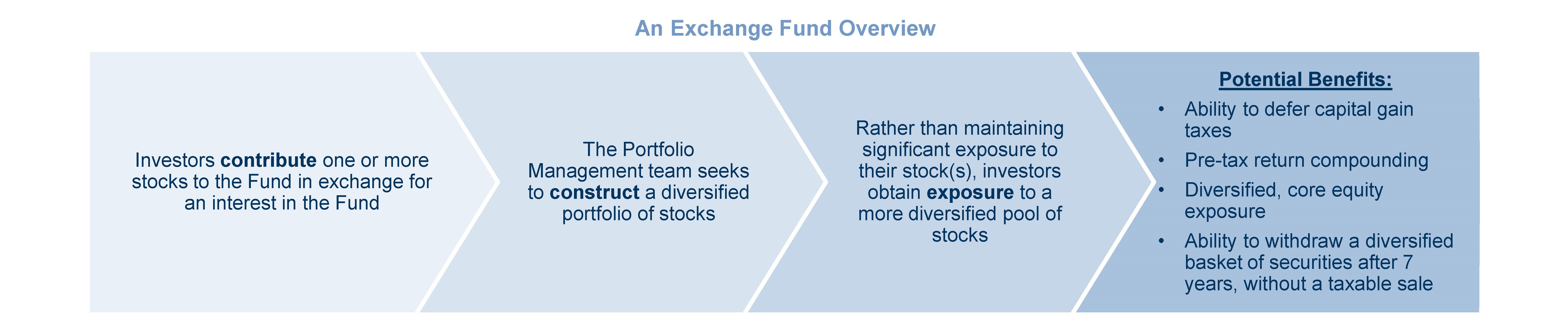

Contributions of appreciated stock(s) to a properly structured exchange fund are not taxable under current federal law. Investors can swap their highly concentrated stock for shares in the exchange fund. The exchange fund holds a large basket of stocks and the investor can achieve diversification without selling their shares and avoid paying capital gains taxes. By investing before tax, investors may benefit from pre-tax return compounding as they’ll receive:

- No tax on contribution

- Carryover of tax cost basis

Not to be confused with exchange-traded funds (ETFs), exchange funds are structured as a limited partnership and have specific requirements that at least 20% of its holdings as illiquid assets like real estate. Unlike ETFs, they do not trade on a stock exchange like typical shares. They are available through only a few large financial firms like Goldman Sachs and Eaton Vance, typically by working with a financial advisor.

Exchange funds have been available to investors since the 1960s, with their popularity ebbing and flowing according to market conditions.[1] They saw a boom of popularity during the tech bubble in the 1990s, when technology companies’ stocks soared, and investors needed a way to reap those gains without paying massive taxes. Now, especially since a 2013 increase in capital gains tax, exchange funds are again attracting attention.

Other Investing Points to Consider

Keep in mind that exchange funds are not for every investor because they do have some limitations to consider. For one, once you invest in an exchange fund, you must keep your assets in the fund for at least seven years. During the first seven years, you can redeem them for the lesser of: 1.) the redemption value of your shares, or 2.) the value of the securities you originally contributed. After seven years, you can receive the actual shares, or the diversified basket of securities from the fund, and without facing capital gains tax.

Exchange funds also typically have a minimum investment requirement of between $500,000 and $1 million. And they’re usually only open to investors with a minimum of $5 million in total investible assets. Investors should also consider the fees, including annual investment fees of about 0.85% to 0.95% as well as an upfront fee of between 0% to 1.5%, depending on the size of the investment. Finally, if you take shares from the fund in the first three years, you can expect an early withdrawal fee, generally of about 1%. While exchange funds do bring impressive tax advantages for wealthy investors, like any investment they have some risks to consider before you swap your shares. It’s possible that the shares in an exchange fund may underperform your original holdings. On the other hand, they also deliver more diversity, so you minimize the risk of overall losses from declines from a single stock.

Finally, exchange funds alone are likely not enough to provide healthy diversity on their own. Afterall, these assets are stocks, and a well-rounded portfolio should include a broader range of asset types – like bonds, commodities or real estate, for example.

Get Started with Exchange Funds

Bull markets like the one we’re in today can bring many rewards. However, investors should be prepared with a good strategy for maintaining their ideal asset allocations to make sure their portfolio matches their risk tolerance as it supports their financial goals.

Learn more about Exchange Funds and other strategies to minimize taxes after your stocks have made massive gains by talking to a financial professional about your personal situation. With personal guidance, you can find the best solution for your financial goals.

Schedule a complimentary 30-minute phone or Zoom financial consultation with Edmond N. Karam, a Financial Advisor at https://www.karamwealth.com/contact or you can email him at Edmond.Karam@LPL.com