Filing taxes after you exercise Incentive Stock Options is a simple 3 step process. It’s easy to understand and best of all, you can do it completely free!

The contents of this page and website are for information purposes only. Any result from our tools, including the IPO Calculator, AMT Calculator and ISO Planner is only an estimation based on the inputs provided. It is not intended to be financial, tax, or investment advice. Please seek a duly licensed professional.

This post may contain affiliate links and I may earn a small commission when you click on the links at no additional cost to you. If you find this article informative, I would appreciate your support!

Quick Summary

- For most tax filing software, to calculate the tax on ISOs, you’ll need a log of ISOs exercised, date of exercise, strike price, and fair market value (FMV) at time of exercise. If you aren’t sure what these terms mean, you can read about the basics of incentive stock options here

ISOs that you exercise and sell in the same calendar year are not subject to AMT. These will be classified as disqualifying dispositions and will be included in your regular income tax. Don’t double count these!

-

Please, for the love of all that is good, stop paying to file your taxes! I cannot stress this enough. The law mandates that everyone should be able to file for free, and there are a multitude of resources that let you do so

-

My recommendation is always to file completely for free through Credit Karma! I’ve personally been using them for 4 years now. If you don’t have an account, you can easily sign up for free!

3 Simple Steps to File Taxes For Your AMT

Step 1: Find your ISO exercise information

You should be able to get all of this information in your brokerage’s Statement/Tax Form section. Whether it’s your individual brokerage (if you’ve left the company) or your company’s equity center, look for a year end Form 3921: “Exercise of an Incentive Stock Option”.

If you’ve changed companies, you may also have a Form 3922, which is just a notice that the shares you exercised were transferred from your company’s equity center to your individual account. You can ignore this one, as all the relevant information is in Form 3921

Form 3921 should have all the information you need to proceed to step 2, including the date of exercise, exercise strike price, and fair market value of the share at exercise.

Step 2: Calculate your ISO exercise spread subtotal

The definition of your ISO exercise spread, for the purposes of this calculation, is the difference between the Fair Market Value of the equity at time of exercise minus the Strike Price, multiplied by the amount of ISOs you exercised.

ISO Spread Subtotal = (FMV - Strike Price) * ISOs Exercised

Do this calculation one grant at a time, and if you exercised from more than one grant, you simply just add all the subtotals together.

If you need help calculating this, you can visit our AMT Calculator . In the results section, look for the table ‘See Alternative Minimum Tax Breakdown’. There’s a line for ‘Total ISO Spread’.

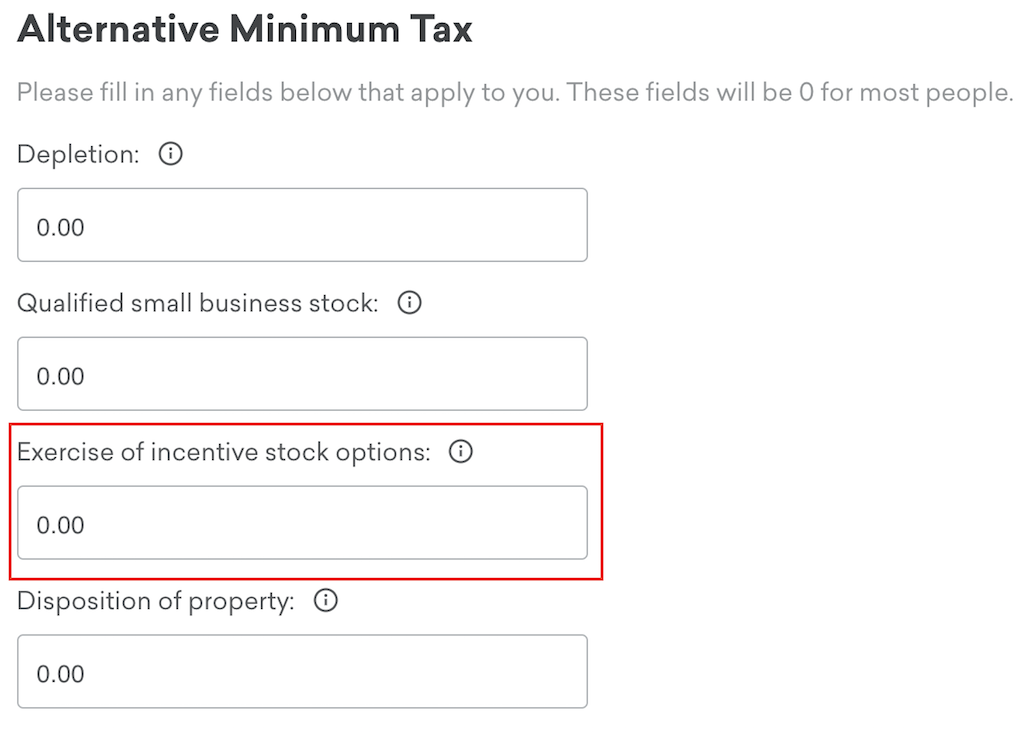

Step 3: Fill this number into IRS Form 6251

IRS Form 6251 is the form you attach to your tax return to denote any Alternative Minimum Tax. Specifically, for exercising ISOs, your subtotal will go into Row 2i “Exercise of incentive stock options (excess of AMT income over regular tax income)”.

Luckily, your filing software should aide you in this without you having to hunt down form 6251 yourself. The reason I use Credit Karma is because they make this extremely clear, intuitive, and it’s literally just one box to fill in.

Step by Step Example

If this is your first time using Credit Karma, they’ll ask you to fill out a few basic questions about yourself so they know what categories of line items to ask you about (deductions, types of income, home ownership, etc). Answer these questions as if you did not exercise any stock options.

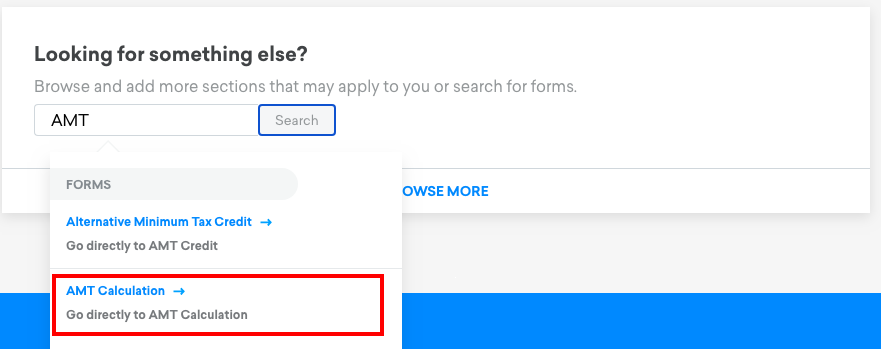

This is because once you’re on your tax home page, simply scroll down to the bottom and look for the search bar. Type in AMT and click ‘AMT Calculation’

Then, simply enter your ISO exercise spread subtotal into the box ‘Exercise of Incentive Stock Options’

That’s it - you’re done! The rest of the information / Form 6251 will be auto populated once you fill in the rest of your regular tax information (i.e. income, deductions, etc) and your AMT will be calculated for you.

Oftentimes, people end up having to pay 10s of thousands of dollars due to unplanned AMT. Start preparing today by checking out our AMT Calculator .