Reduce your tax bill dollar for dollar in under 5 minutes by claiming the Alternative Minimum Tax Credit on your tax return

The contents of this page and website are for information purposes only. Any result from our tools, including the IPO Calculator, AMT Calculator and ISO Planner is only an estimation based on the inputs provided. It is not intended to be financial, tax, or investment advice. Please seek a duly licensed professional.

This post may contain affiliate links and I may earn a small commission when you click on the links at no additional cost to you. If you find this article informative, I would appreciate your support!

Quick Summary

-

Just because you paid AMT in previous years does not mean you qualify for the AMT credit. See a general overview here

-

In addition, you also can only use the AMT Credit in a year where you do not owe AMT again!

-

Filling out Form 8801 is a piece of cake with the right tax software, specifically in regards to the exercising of Incentive Stock Options

-

I always recommend Credit Karma as the tax filing program of choice, as it's completely free and is the one I've used for the past 4 years. If you don’t have an account, you can easily sign up for free! We’re going to use this as an example for this article.

Step 1: Locate your old IRS Form 6251

IRS Form 6251 is the form you had filled out in a previous tax year when determining if and how much AMT you owe.

If you’re not sure what it looks like, here’s the link to the form on the IRS website

On Credit Karma, and likely any other tax program you use, you should easily be able to pull it up in your account’s previous tax forms.

Step 2: Fill out Form 8801 using relevant inputs from Form 6251

Navigate to your Credit Karma tax homepage. If you just started filing your taxes, you might need to reconfirm or fill out some basic information to unlock the rest of the page. This is simply just to get a sense of what things you’ll be filing and reduce the clutter you see.

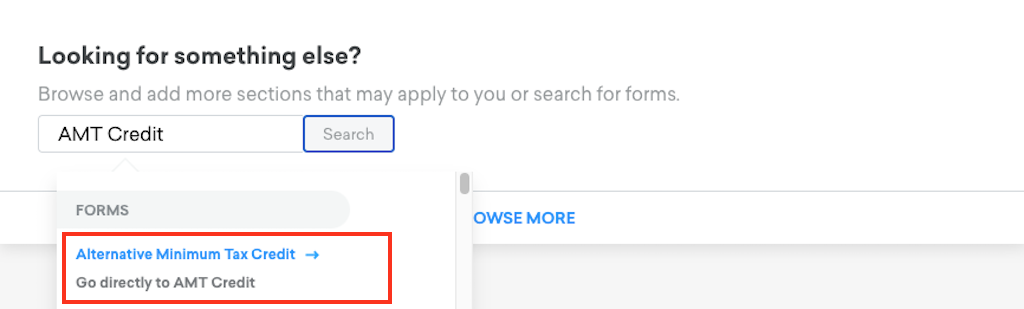

Scroll down to the bottom of the page and look for the search bar. Type in AMT Credit and click on the first result.

You’re then going to be asked a few pages of questions. All you need to do is fill in the numbers from your previous Form 6251 into the relevant boxes. All the instructions actually tell you exactly which row or subrows to pull from and it should be pretty straightforward.

You’ll notice that they don’t ever ask you for Row 2i - ISO Exercise Spread Subtotal. This is because they only ask you about Exclusion Items which as mentioned in this article, are ones that do not qualify for the AMT Credit! The ISO exercise spread is luckily a deferral item that counts, so we’re in the clear!

At the end of all the inputs, Credit Karma will combine your inputs with the rest of your tax return and spit out your ultimate ‘AMT Credit’ number you can apply. This is a one-to-one credit so every dollar of credit you have reduces your tax owed by that much!

And that’s pretty much it! As mentioned, keep track of how much of the credit you’re using and how much you have left, as this is not something the IRS regularly has records of. It’ll be on you to prove the numbers used if you were to ever get audited!